Prevailing Winds of the Petroleum Market

Jan 05, 2024

By Jeremy Peebles, GCC VP Petroleum

Oil markets in 2023 - a recap

Starting this year at $80.18, WTI Crude witnessed volatility in the first half, surging above $90 in September before reversing course and finishing the year just under $72. The three most influential factors shaping the landscape were:

The momentum continued in June when Saudi Arabia, a key OPEC member and one of the world's top three oil producers, voluntarily committed to an additional 1 mbpd cut, aiming to support oil market stability and balance. This decision contributed to a 25% increase in oil prices, peaking at $97.

However, despite these measures, the continued lagging economic recovery in China and economic slowdowns in various European nations posed obstacles to sustained, long-term rallies in oil prices. Raising inflation and high interest rates kept downward pressure on oil prices as the talk of recession loomed. The U.S. achieved a new record in annual crude oil production in the last quarter of 2023 nullifying any supply constraints caused by OPEC. Currently, oil is trading down about 8% to end the year.

Looking ahead to 2024

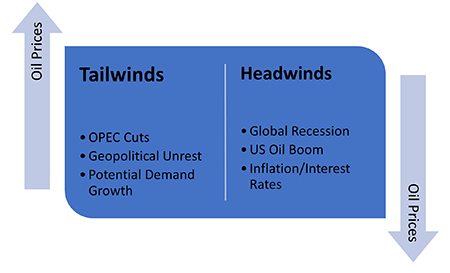

The trajectory of oil markets into 2024 is poised for substantial shifts, as Middle Eastern producers try to claw back more of their market share. Demand, meanwhile, remains uncertain, particularly as big energy consumers like China deal with slowing economic activity. An impending recession, a deepening slowdown in the major economies of the world, less than expected crude demand from China, and less production will be defining features for oil markets in 2024. Notably, several headwinds and tailwinds from 2023 persist, shaping the narrative as we move into 2024.

The outlook for oil markets is tied to OPEC+ policies, with a spotlight on Saudi Arabia's commitment to supporting prices. While the group has demonstrated its resolve in 2023, the prospect of deeper cuts may pose challenges for consensus within OPEC+. Presently, I anticipate a balance in oil supply over the first half of 2024, transitioning into a deficit in the latter half. This shift is expected to drive prices higher from current levels. However, a key risk factor lies in the potential for heightened tensions in the Middle East and stricter enforcement of US sanctions against Iran, which could significantly tighten the oil market.

Despite prevailing market sentiments that price in a looming recession, I believe that oil is undervalued, especially as the likelihood of a recession appears to diminish. If the economy experiences an upturn, oil is anticipated to closely follow suit. The Energy Information Administration echoes a positive outlook for oil in 2024, foreseeing a gentle landing for the global economy and the potential for Federal Reserve rate cuts. Aligning with this optimism, Wall Street analysts provide a conservative average estimate of $89 for WTI crude, further contributing to the positive narrative surrounding oil markets in the coming year.

Oil markets in 2023 - a recap

Starting this year at $80.18, WTI Crude witnessed volatility in the first half, surging above $90 in September before reversing course and finishing the year just under $72. The three most influential factors shaping the landscape were:

- Production cuts from OPEC

- Global recession fears

- China’s slow economic recovery

The momentum continued in June when Saudi Arabia, a key OPEC member and one of the world's top three oil producers, voluntarily committed to an additional 1 mbpd cut, aiming to support oil market stability and balance. This decision contributed to a 25% increase in oil prices, peaking at $97.

However, despite these measures, the continued lagging economic recovery in China and economic slowdowns in various European nations posed obstacles to sustained, long-term rallies in oil prices. Raising inflation and high interest rates kept downward pressure on oil prices as the talk of recession loomed. The U.S. achieved a new record in annual crude oil production in the last quarter of 2023 nullifying any supply constraints caused by OPEC. Currently, oil is trading down about 8% to end the year.

Looking ahead to 2024

The trajectory of oil markets into 2024 is poised for substantial shifts, as Middle Eastern producers try to claw back more of their market share. Demand, meanwhile, remains uncertain, particularly as big energy consumers like China deal with slowing economic activity. An impending recession, a deepening slowdown in the major economies of the world, less than expected crude demand from China, and less production will be defining features for oil markets in 2024. Notably, several headwinds and tailwinds from 2023 persist, shaping the narrative as we move into 2024.

The outlook for oil markets is tied to OPEC+ policies, with a spotlight on Saudi Arabia's commitment to supporting prices. While the group has demonstrated its resolve in 2023, the prospect of deeper cuts may pose challenges for consensus within OPEC+. Presently, I anticipate a balance in oil supply over the first half of 2024, transitioning into a deficit in the latter half. This shift is expected to drive prices higher from current levels. However, a key risk factor lies in the potential for heightened tensions in the Middle East and stricter enforcement of US sanctions against Iran, which could significantly tighten the oil market.

Despite prevailing market sentiments that price in a looming recession, I believe that oil is undervalued, especially as the likelihood of a recession appears to diminish. If the economy experiences an upturn, oil is anticipated to closely follow suit. The Energy Information Administration echoes a positive outlook for oil in 2024, foreseeing a gentle landing for the global economy and the potential for Federal Reserve rate cuts. Aligning with this optimism, Wall Street analysts provide a conservative average estimate of $89 for WTI crude, further contributing to the positive narrative surrounding oil markets in the coming year.